- HomeTake me back

- InsuranceSR22, Travel, Gap & More

- About UsWe're here for you!

- Latest NewsPublications

- Contact UsGet started today!

(800) 967-4386

My name is Jay Freeman and I am a Texas insurance agent specializing in the issuance of the Texas SR-22 form for over 35 years. My purpose in writing this series is to provide some guidance for those people who find themselves in the position of needing to obtain a Texas SR-22. My goal is to simply explain what the SR-22 is and some of the problems and pitfalls that can be avoided when it comes to obtaining the form.

A Texas SR-22 (or Financial Responsibility Form) is not a stand-alone form; it is actually an endorsement that is attached to an automobile insurance policy. This is why you cannot purchase the SR-22 by itself, you have to actually purchase a policy and the insurance company that provides the policy then issues the form. When an insurance company issues the SR-22, they are obligated to constantly monitor the policy status and notify the Department of Public Safety if that status changes. If the policy to which the SR-22 is attached cancels, then the insurance company is required to submit the second part of the SR-22 form (called the SR-26) to DPS and this notifies the department that the SR-22 has been cancelled. Think of it like a light switch… when DPS receives the SR-22 from the insurance company, the light switch flips to “on” because the requirement has been met. When the policy cancels, the SR-26 is sent to DPS and then the switch flips to “off” because the SR-22 is no longer in force. If at that time there is no longer a requirement at DPS for the driver to have an SR-22 on file, then everything just goes back to normal. If however DPS still requires that the driver maintain an SR-22, then they will begin the process to suspend the driver’s license.

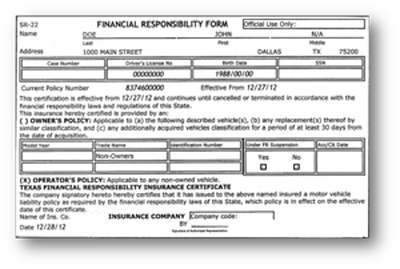

Prior to 2010 the SR-22 was required to be pink in color; this requirement was removed when the DPS began allowing the forms to be submitted electronically. Many companies still issue the SR-22 on pink paper (probably because that’s the way it’s always been done) but it is not a DPS requirement.

There are a few more items about the SR-22 that I would like to mention. First, you might notice that there is an Effective Date but no Ending Date. This is because once the SR-22 is issued; it is active until the SR-26 is submitted to DPS. Next you will see that the Case Number field is left blank. Sometimes insurance companies will try to avoid issuing the SR-22 by stating that they first need the court case number. The Case Number field is actually referring to the DPS Case Number which is the Driver’s License number. We always leave the Social Security field blank; it is not required by DPS and therefore it would be unwise to have such personal information passing through so many hands. Finally, either the Owner’s Policy or Operator’s Policy will be marked. If the Owner’s box is marked, there will be information describing the vehicles listed on the policy in those fields. If the Operator’s box is marked, those fields will be left blank. The difference between these two types of policies (and the advantages of one over the other) will be discussed in Part 3 of this article.

In many cases, a person’s ability to legally drive hinges upon whether or not the Texas Department of Public Safety has record of an SR-22 filed with their office. Here are just a few of the reasons that the State of Texas requires that an SR-22 be filed:

There are other reasons why an SR-22 might be required, but these are the most common.

This question requires us to look at a couple of factors in order to be answered properly. You see, even though the Texas Department of Public Safety regularly advises people to obtain the SR-22 form from their automobile insurance provider; that is not always possible. Many insurance carriers consider the SR-22 to be an indicator of a “sub-standard” or “high-risk” driver; so if a driver who is already insured with the company requests an SR-22, this sends up warning flags to the company underwriters. An insurance company is required to file its underwriting guideline with the Texas Department of Insurance; and then it must follow that guideline for all clients or face penalties. If the company you are currently insured with provides coverage for “sub-standard” or “high-risk” drivers (people with multiple tickets or accidents on their driving record), then the best advice is to talk to your current insurance agent about obtaining the SR-22.

However, if your current automobile insurance carrier is one of those companies that specialize in providing coverage for “standard” or “preferred” drivers, then obtaining the SR-22 from your current company can become much more difficult. Here are some of the potential problems to be aware of:

As I explained in Part 2 of this article, if you already have your automobile insurance through a “high-risk” company it is usually a better option for you to contact your existing insurance agent about providing the SR-22. However, if you are currently insured through a “standard” or “preferred” carrier then it is usually a better option to obtain the SR-22 from a secondary, outside source. However, if this is not done properly it could create some problems that have the potential of being financially devastating.

Without proper guidance, many people will simply turn to the first insurance agency they see advertising SR-22s and ask to purchase the form as inexpensively as possible. The agency will then typically issue a minimum-limits liability-only policy (because this is the least expensive coverage required to issue the SR-22) on whatever vehicle the person happens to be driving that day. The agency is happy because they have sold a policy and the person is happy because they have the form they need; the problem is that the person has now automatically terminated his current insurance coverage on that vehicle through his “preferred” carrier and replaced it with this minimum-limits liability-only policy. Imagine the problems this could cause if there is an auto accident and the person discovers there is no longer coverage for the damage done to his vehicle, or coverage protecting the lien-holder if the vehicle is financed, or any liability loss that exceeds the state minimum limits, or car rental, or towing coverage, etc…

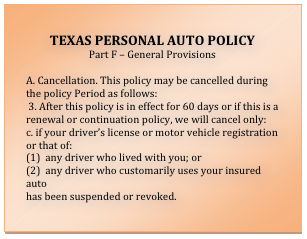

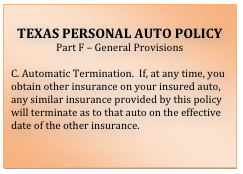

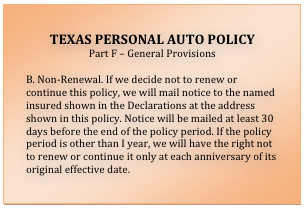

The problem lies in the Texas Personal Auto Policy (see text insert for exact wording). You see, a person can be listed on multiple policies as a driver but a vehicle can only be listed on one policy at a time… if you start a policy on a vehicle it actually voids all prior coverage on that vehicle. This rule is in the policy to prevent someone from committing insurance fraud by purchasing multiple policies on a vehicle, then staging an accident and filing multiple claims for the same loss. This rule only applies to the single vehicle listed on the new policy and would have no effect on any additional vehicles listed on the original policy.

Although this might seem to present an insurmountable dilemma, this situation can be easily solved by purchasing the SR-22 attached to an Operator’s Policy (also commonly referred to as a Non-Owner’s Policy). Instead of providing coverage on a specific listed vehicle, this type of policy is written on the person as a driver. Because it does not provide duplicate coverage on a vehicle already insured on another policy, it completely avoids the Automatic Termination rule in the Texas Personal Auto Policy.

It is important to understand that the Operator’s Policy does not replace your regular auto insurance coverage; it is simply an additional policy that covers you while driving in very specific and limited circumstances. For example, the Operator’s Policy would not provide any coverage for a vehicle you own, rent or lease. Nor would it cover any vehicle that is provided for your regular use or is driven in the course of your employment. It is designed to provide liability coverage for damage you cause while driving a vehicle that you do not own and is not available for your normal use. However because the coverage is so limited, the cost of an Operator’s Policy is generally more affordable than many other options.

Sometimes locating a company willing to issue an Operator’s Policy is not that easy. I occasionally have my clients tell me they were informed by another insurance agent that they could not purchase a Non-Owner’s or Operator’s policy because they own a vehicle. I believe there are a couple of different reasons why someone might be told this. First, it is entirely possible that the insurance company that agent represents does not allow an Operator’s Policy to be issued if the applicant owns a vehicle due to that company’s underwriting guidelines. That is not a state regulation but simply a company policy determining what type of risk that particular company either will or will not accept. Secondly, some agents view the SR-22 as an opportunity to take over a substantial portion of that family’s insurance business. They understand the effects an SR-22 can have on a family’s policies (as I discussed in Part 2 of this article), especially if they are currently insured with a “preferred” company. They see the requirement for the SR-22 as a way to get their “foot in the door” and possibly convince the family to change insurance agents. As a rule of thumb, if an agency wants you to provide information about a vehicle… they are NOT! offering to sell you an Operator’s policy.

Please understand that the use of a Non-Owner’s or Operator’s policy is not the perfect solution for everyone needing an SR-22. If you have a vehicle that is not currently insured, then the best solution for you is to go to an agent that specializes in SR-22s and purchase an SR-22 policy that will cover your automobile. If you currently have insurance coverage through a “non-standard” or “high-risk” company, then your best option would be to contact your agent about adding the SR-22 to your existing policy. However, if you are currently insured through a “standard” or “preferred” carrier and do not want anything to disrupt your existing coverage, then the Non-Owner’s or Operator’s policy could be the best option for you.

Additionally, there are instances where the Operator’s Policy would be the only option available to you if you are required to file an SR-22. For example; if you do not own a vehicle but occasionally drive borrowed autos, you would need to purchase an Operator’s policy in order to obtain the SR-22 form. Another example would be a scenario in which the only vehicle you regularly drive is provided for your use by your employer. That vehicle would typically be insured under a commercial or business policy which would not normally be able to provide the SR-22.

Surprisingly the answer to this question is probably not… unless you tell them about it. You have absolutely no requirement or obligation to notify your insurance company about any changes to your driving record or the need for an SR-22 filing (the exception to this is if you are in an accident and especially if another vehicle is involved; these incidents should always be reported to your agent).

When you first purchased your insurance policy you were required to truthfully complete an application which was reviewed and underwritten by the insurance company; this information in addition to the reports the insurance company obtained on you and the other drivers listed on your policy are the factors that determined the rate you were charged for your insurance coverage. Once your policy is in force, it is the responsibility of the insurance company to determine if there are any new factors that have occurred in the past policy term that might impact the premium you pay for your insurance; and as a matter of doing business, many insurance companies do not normally perform an in-depth underwriting review prior to offering to renew a client’s policy.

Due to the substantial cost of performing these reviews (consider that a driving record cost an insurance company around $10 per insured, then multiply that cost by the number of people insured by that company and I’m sure you can imagine the expense), many companies rely primarily on the policy holder’s claims history to determine premium changes. From the insurance companies point of view… if you have not cost the company any money (by filing claims), they are often happy to renew your policy at the current premium and therefore save the underwriting expense. You might have already experienced this yourself if you have ever received a traffic ticket and expected to see an increase in your insurance premium, only to discover that there was no change at renewal. It often occurs that many convictions and tickets are simply never discovered.

In addition, most insurance companies only take into account the last three years (a very, very few will review up to five years) of a client’s driving record in determining insurance premium. So if a person has a conviction on their record but the insurance company does not bother to check, after three years (in most cases) that conviction will no longer affect the insurance premium.

It is also helpful to understand that you are dealing with two separate entities; your insurance agent who wrote and services your policy, and the insurance company who underwrites your policy and determines the premium you pay. If you are currently insured with a “preferred” carrier, in most cases your insurance agent does not want to know anything about your SR-22 filing. Your agent has probably spent a great deal of effort in developing you as a client and your policies represent a source of your agent’s income; the last thing in the world your agent wants is a situation to arise that threatens your relationship as a customer. I have even been told by insurance company underwriters that they would prefer not to know about an SR-22 filing, however if discovered they normally have no option but to act because under insurance regulations they are required to follow the company’s underwriting guideline.

This all being said, it is important to understand that the information I have shared here is simply a general overview as to how many insurance companies operate. All insurance companies are different and any company may conduct an underwriting review at any time; I am just attempting to explain that it is certainly not a foregone conclusion that a violation, a conviction or the SR-22 filing will ever be discovered.

Here are a few additional points to keep in mind regarding your insurance carrier and the SR-22 filing:

As I explained earlier in this segment, in the vast majority of cases your insurance agent does not want to lose your business. In addition, your agent also does not want you out talking to other agents in the attempt to secure an SR-22; your agent does not want to take the chance that you might be convinced to move your policies. In the final part of this article I will discuss an option for the SR-22 that many agents offer to keep all of your policies under their control, but it could cause more problems than it solves.

I often run into another situation that I feel it is important that you are made aware. Due to a lack of experience in dealing with the many, varied situations that require an SR-22 filing, some insurance agents try to make all “square-peg” SR-22 requirements fit into the same “round-hole” solution. This usually occurs when a person turns to their “standard” or “preferred” insurance agent to obtain the SR-22. These agents tend to be somewhat less knowledgeable about these filings because the SR-22 is not a normal part of their everyday business; but they do understand that because this client needs an SR-22, they are at risk of losing this customer. So, they offer to provide the SR-22 by selling the client an SR-22 policy written through the Texas Auto Insurance Plan Association (TAIPA), or commonly referred to as the State Pool.

The TAIPA is a program that allows a Texas insurance agent to write a policy that will provide the minimum limits of Liability, Personal Injury Protection and Uninsured/Underinsured Motorists Coverage for a client who is unable to obtain a policy in the general marketplace. It is designed as an alternative insurance market for those drivers who have been deemed uninsurable. All insurance companies licensed to write automobile insurance in Texas (with the exception of County Mutual companies) are required to be members of TAIPA. These companies are assigned the policies of these otherwise uninsurable drivers based on the number of voluntary policies the company writes… so if Company A writes 15% of the automobile policies in Texas, then Company A will be assigned 15% of the TAIPA policies.

Even if the agent does everything correctly (for instance, he submits the application for a Non-Owner’s policy rather than an Owner’s Policy and thus avoids the duplicate coverage problems I outlined in Part 3 of this article), there are still some serious problems that can arise. To understand these problems, it is helpful to understand how the TAIPA application process works:

First, the agent completes and submits an application and premium payment for the client to TAIPA, this application has a place where the SR-22 filing is requested. Instead of the actual SR-22 form, the client receives a copy of this application. Once TAIPA receives the application requesting the SR-22, what happens next depends on how the application was completed. If the application indicates that the client’s driver license is currently suspended and a separate check for the reinstatement fee is attached or the application indicates that the client’s driver license is currently not suspended and no fee is required, TAIPA will issue the SR-22 and submit it directly to the Texas Department of Public Safety (DPS). Otherwise, TAIPA will issue the SR-22 and mail it back to the agent. TAIPA then sends the application to the assigned company and that company processes the policy.

Here are the areas where the problems occur:

To be clear, there are drivers who do not qualify for coverage in the normal insurance marketplace; for these drivers, TAIPA might very well be the best option available. However if you are simply trying to purchase an SR-22 through a secondary market because your current insurance carrier either can’t or won’t provide one… well, TAIPA is probably not the solution for you.

In closing, I would like to thank you for taking the time to read this article. My goal was to produce a guide which honestly answers the questions about SR-22s which I have been asked over and over again during the past 35 plus years. My company website, ConceptSR22.com, was developed to address the problems and solutions I have outlined here. If you need assistance with these issues, please visit my website or contact my office.

Thank you – Jay Freeman

Jay Freeman is the owner of ConceptSR22.com, a website specialized in solving Texas SR-22 problems. If you need assistance in obtaining a Texas SR-22 or have questions not addressed in this series, please contact his office from the website. Thank you for reading this series..

© Jay Freeman – This article may be copied and distributed with original attribution and permission of author.

Accurate Concept Insurance

972-386-4386 ~ 800-967-4386

Serving Texas since 1993